Fraud Response Compliance Risk Mitigation Network 3501017604 3806408190 3509681277 3475335175 3881180016 3533499830

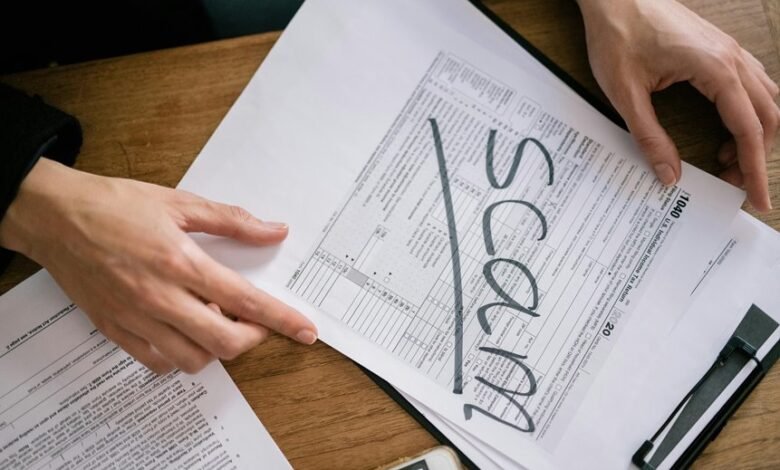

The Fraud Response Compliance Risk Mitigation Network provides essential frameworks for organizations managing identifiers like 3501017604 and 3806408190. By emphasizing compliance and risk management, it seeks to enhance fraud detection capabilities. This structured approach promotes a vigilant culture within organizations. However, challenges persist in adapting to evolving fraudulent tactics. Understanding these dynamics is crucial for fostering resilience in financial security strategies. What measures can be taken to strengthen these frameworks further?

Understanding the Fraud Response Compliance Risk Mitigation Network

Understanding the Fraud Response Compliance Risk Mitigation Network is essential for organizations aiming to effectively safeguard their assets and maintain regulatory compliance.

This network enhances fraud detection capabilities through the integration of robust compliance frameworks. By establishing clear protocols and fostering a culture of vigilance, organizations can proactively address potential risks, ensuring both financial security and adherence to evolving legal standards while preserving operational freedom.

Key Strategies for Effective Fraud Prevention

While the landscape of fraud continues to evolve, organizations must adopt key strategies for effective fraud prevention to safeguard their assets and maintain trust.

Comprehensive employee training enhances awareness and vigilance against fraudulent activities, while regular risk assessments identify vulnerabilities.

Tools and Technologies to Combat Fraud

Organizations increasingly leverage advanced tools and technologies to combat fraud effectively. Implementing sophisticated fraud detection systems enhances their ability to identify suspicious activities in real-time.

Additionally, robust cybersecurity measures protect sensitive data, ensuring operational integrity. By utilizing machine learning algorithms and data analytics, organizations can proactively mitigate risks, creating a resilient framework against evolving fraudulent tactics and fostering a secure environment for stakeholders.

Building a Culture of Compliance and Ethical Conduct

To effectively combat fraud, fostering a culture of compliance and ethical conduct within an organization is essential.

Ethical leadership plays a pivotal role in establishing this environment, guiding employees toward integrity. Implementing comprehensive compliance training programs reinforces these values, empowering staff to recognize and report unethical behaviors confidently.

Ultimately, a commitment to ethics promotes transparency and accountability, significantly reducing the risk of fraudulent activities.

Conclusion

In conclusion, the Fraud Response Compliance Risk Mitigation Network stands as a vigilant lighthouse in the stormy seas of financial misconduct. Just as a lighthouse guides ships away from treacherous waters, a robust compliance framework directs organizations through the complexities of fraud prevention. With the integration of advanced technologies and a commitment to ethical conduct, entities can navigate risks effectively, ensuring their assets remain safeguarded against the ever-present threat of fraud in an evolving landscape.